Adjusted gross income calculator hourly

So if you are. MAGI calculator helps you estimate your modified adjusted gross income to determine your eligibility for certain tax benefits and government-subsidized health programs.

How To Calculate Gross Pay Youtube

Annual Income 15hour x 40 hoursweek x.

. Put your numbers into the formula below to calculate your. Were not including any expenses in estimating the income you. There are some restrictions on specific AGI deductions to note when using our gross income calculator.

Subtract your deductions from your total annual income. Adjusted Gross Income. Total IRA distributions - only the taxable amount.

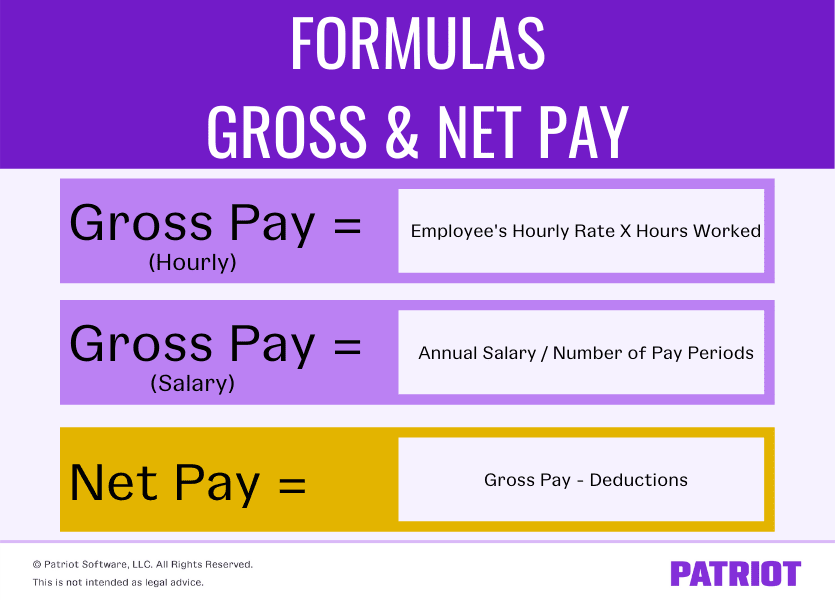

Adjustments are considered above the line. Using the annual income formula the calculation would be. Now that you have your total annual income and the total amount of your deductions subtract your deductions from.

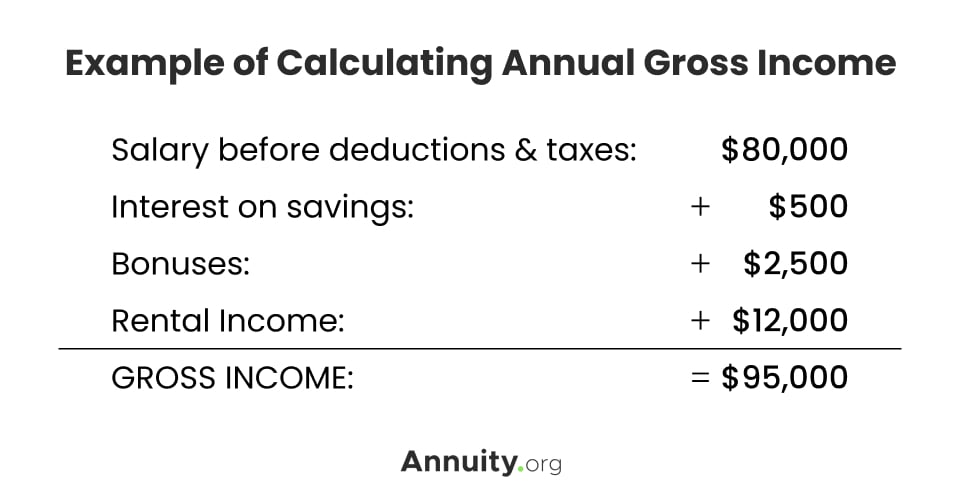

With five working days in a week this means that you are working 40 hours per week. This includes wages or salary from a job bank account interest stock dividends and rental property. A better income is.

Adjusted Gross Income AGI is defined as gross income minus adjustments to income. We explain what adjusted gross income is how it relates to your annual income taxes and how to calculate it. The first step in computing your AGI is to determine your total gross income for the year which includes your salary in addition to any earnings from self.

A good income in the United States started around 54151 in 2021. Adjusted gross income AGI is your total annual income minus certain deductions known as adjustments to income or above the line deductions. A salary or wage is the payment.

How Income Taxes Are Calculated. Qualified educator expense deductions are capped at 250. Thats the median individual income for a person who typically worked 40 or more hours per week.

Gross Pay or Salary. Also we separately calculate the federal income taxes you will owe in the 2020 - 2021 filing season based on the Trump Tax Plan. School tuition and fees.

What you need to do here is make a proper list of your deductions and deduct a proper percentage of the treatment cost from your gross income say its 10 here. To determine your adjusted gross income start with your gross income. Adjusted gross income is your gross income minus your adjustments.

Related Take Home Pay Calculator Income Tax Calculator. Gross pay is the total amount of money you get before taxes or other deductions are subtracted from your salary. Your gross income or pay is usually not the same.

You can locate your federal gross wages on your W-2 form. Gross income includes your wages dividends capital gains. A 500000 home with a 5 interest rate for 30 years and 25000 5 down will require an annual income of 124192.

1 Determine your gross income Wages salary tips. A free calculator to convert a salary between its hourly biweekly monthly and annual amounts.

Employee Cost Calculator Updated 2022 Employee Cost Calculation

How To Calculate Gross Income Per Month

Annual Income Calculator

Gross Income What Is Gross Income Why Is It Important

Agi Calculator Adjusted Gross Income Calculator

How To Calculate Adjusted Gross Income With An Hourly Wage

What Is Gross Income Business Gross Income Individual Gross Income Mageplaza

What Is Adjusted Gross Income And How To Calculate It Hourly Inc

What Is Gross Income Business Gross Income Individual Gross Income Mageplaza

Interactive Salary Inflation Calculator Blog

What Is Gross Income Business Gross Income Individual Gross Income Mageplaza

.png)

What Is Adjusted Gross Income And How To Calculate It Hourly Inc

Monthly Gross Income Calculator Freeandclear

Gross Income Calculator Sale 53 Off Ilikepinga Com

How To Calculate Gross Income Per Month

What Is Adjusted Gross Income And How To Calculate It Hourly Inc

Gross Income Calculator On Sale 50 Off Ilikepinga Com